The seaport industry in 2024 has many signs that are expected to create a premise for recovery in the first half of 2024 such as benefiting from trade growth, increased service prices thanks to Circular 39 taking effect, and the Red Sea event can cause a sudden increase in fares.

Many signs of recovery in the short term

Vietnam’s total import and export value of goods in 2023 will reach 683 billion USD, down 6.5% compared to 2022. Of which, the export value of goods will reach 355.5 billion USD, down 4.4% compared to 2022.

According to ACB Securities Company (ACBS), although it has not yet achieved positive growth again in 2023, the volume of goods through the country’s seaports has had positive changes in the last 6 months of the year and the recovery momentum has increased. Rotate between product groups. In particular, the improvement was led by container and dry cargo groups in the second quarter, followed by liquid cargo groups in the fourth quarter.

The decline in import and export value has narrowed from the end of September 2023 until the end of the year. Notably, in September, the growth rate was 2.8%, October and November increased by 6.3% and December increased by 12.7% over the same period.

According to ACBS, these signals are expected to create a premise for continued recovery in the first half of 2024.

In addition, the adjustment to increase the service price bracket according to Circular 39/2023/TT-BGTVT (on the price bracket for pilot services, services using bridges, wharves, mooring buoys, container loading and unloading services and towing services at Vietnamese seaports will help seaports improve revenue, especially deep-water ports.

Specifically, Circular 39 takes effect from February 15, 2024, adjusting to an increase of about 10% compared to the price specified in the previous Circular 54 on the price of import-export, transit and container loading services. transit in some areas. The price for loading and unloading imported, exported and temporarily imported and re-exported containers in area I is from 36 – 53 USD/20ft and 55 – 81 USD/40ft with goods, seaport group No. 5 has a price for loading and unloading containers from 23 – 27 USD/20ft and 34 – 41 USD/40ft.

Particularly, the two deep-water seaports Lach Huyen and Cai Mep – Thi Vai are subject to separate price frames. The price range for loading and unloading containers from ships (barges) to the port yard for imported, exported, temporarily imported and re-exported containers is from 57 – 66 USD/20ft of cargo; 85 – 97 USD/40ft and for containers over 40 feet, the loading and unloading price is from 94 – 108 USD/container. For transshipment containers, loading and unloading prices range from 34 – 40 USD/20ft and 51 – 58 USD/40ft with cargo.

ACBS believes that this new Circular will impact each port/area differently. For deep-water port clusters in special areas such as Cai Mep – Thi Vai (where the main routes to the Americas and EU are concentrated) and Lach Huyen (Hai Phong – where routes to China or intra-Asia are concentrated). ), the new cost level will support ports to optimize the operation of large vessels; At the same time, it stimulates increased investment in additional exploitation capacity.

For port clusters upstream of Cam River such as Viconship, Green Port, Chua Ve, Doan Xa, which have strong competition, differentiation in resources and uneven scale of operations, the floor handling level has been raised. will partly reduce the pressure on lowering prices, helping to improve the overall business situation in this area.

Sharing the same view, VNDirect Securities Company also believes that the seaport industry can benefit from trade recovery and improve gross profit margin thanks to price adjustment when Circular 39 takes effect.

Accordingly, VNDirect expects import and export prices in 2024 to increase by 8% and 6% respectively over the same period. This securities company forecasts that recovering trade activities can support the recovery of container output with an increase of 4.5% in 2024.

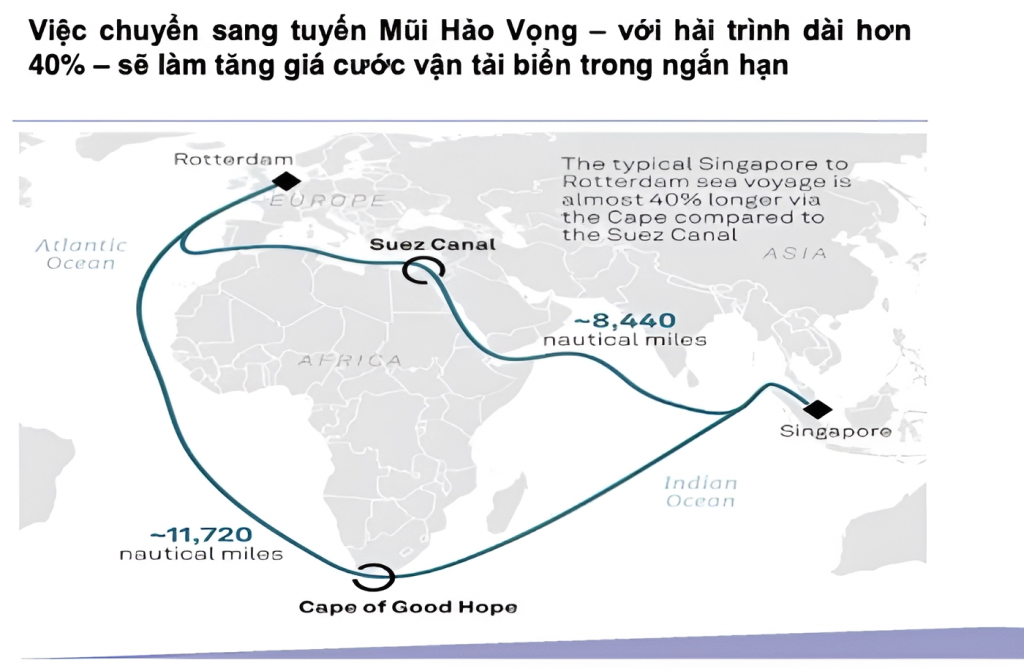

Along with that, VNDirect believes that the disruption in the Red Sea will cause freight rates to increase in the short term. Specifically, in December 2023, some armed forces in China contributed to increasing geopolitical tensions in the region with an attack on cargo ships in the Red Sea area. These moves increase risks to global trade.

Attacks in the Red Sea and uncertainties at other global trade gateways, such as the drought at the Panama Canal, will lead to serious challenges to trade flows this year. 2024. According to VNDirect, these factors may cause disruption and stagnation in the shipping industry, leading to sudden increases in freight rates in 2024.

However, this securities company also believes that disruption or blockage at the Suez Canal (if any) will impact the costs of export/import businesses more than it will impact seaport business in Vietnam.

Deep-water ports have long-term advantages

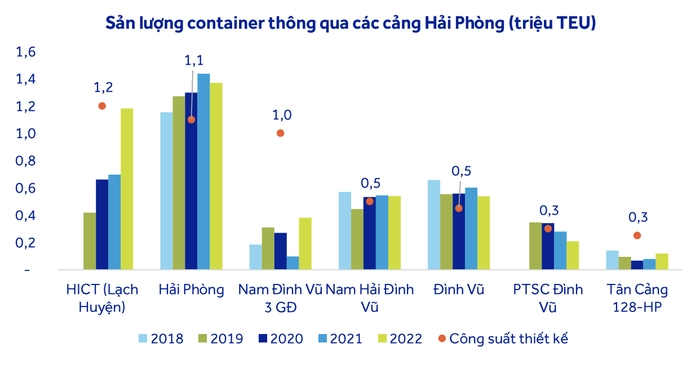

According to ACBS, the deep-sea port will lead the growth of international trade in the long term, focusing on two key areas: Hai Phong and Ba Ria – Vung Tau.

Hai Phong and Ba Ria – Vung Tau seaports are both considered to have the most development potential, with proportions accounting for about 22.4% and 10.2% of the total volume of goods through the country’s seaport system, respectively, and there is still plenty of room to increase investment capacity.

For the Hai Phong port group, seaport supply will increase significantly thanks to the contribution of Nam Dinh Vu port phase 3 (capacity of 600,000 TEU/year) and Lach Huyen terminals 3 and 4 (capacity of 1.1 million TEU/year) in 2025.

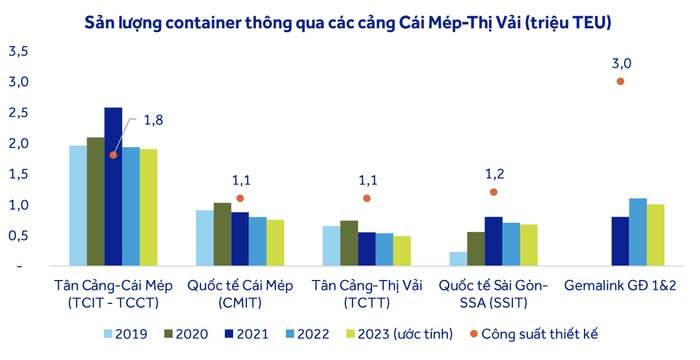

For the Cai Mep – Thi Vai cluster, Gemalink port phase 2 with an increased capacity of 1.5 million TEU/year is in the process of completing procedures to apply for a license to expand its scale. Specially for Cai Mep – Thi Vai port, ABCS believes that the growth momentum in this port cluster comes from its important role in international trade and the partial importation of goods from the port in Ho Chi Minh City.

It is known that the southern region has three main rivers: Saigon, Hiep Phuoc – Soai Rap and Cai Mep – Thi Vai. In particular, according to the development plan, ports on the Saigon River will be relocated, or converted to function, or operated until the end of their term without being renovated, upgraded and expanded.

Hiep Phuoc – Soai Rap port cluster maintains its planning when the navigation channel is guaranteed to receive ships of about 50,000DWT. These ports will be the main port areas to gradually replace general cargo and containers for ports in Ho Chi Minh City.

“The Cai Mep – Thi Vai area has natural conditions suitable for developing a deep-water port, with a draft of 14 – 16.5m suitable for receiving large ships of over 80,000DWT. The proportion of goods passing through Ba Ria – Vung Tau seaport increases from 31.7% to 36.5% in 2022, specifically container goods increase from 23.5% to 32.1%; while the proportion of goods passing through the Ho Chi Minh City’s seaport decreased from 61.8% in 2015 to 55.2% in 2022, container cargo decreased from 70.1% to 59.8%,” ACBS said.

Vina Aspire is a consulting company, providing IT solutions and services, network security, information security & safety in Vietnam. Vina Aspire’s team includes skilled, qualified, experienced and reputable experts and collaborators, along with major domestic and foreign investors and partners to join hands in building.

Businesses and organizations wishing to contact Vina Aspire Company with the following information:

Email: info@vina-aspire.com | Website: www.vina-aspire.com

Tel: +84 944 004 666 | Fax: +84 28 3535 0668

![]()

Vina Aspire – Vững bảo mật, trọn niềm tin

VINA ASPIRE UNVEILS OFFICIAL BRAND AMBASSADOR MIRA – INTELLIGENCE. ELEGANCE. TECHNOLOGY.

VINA ASPIRE UNVEILS OFFICIAL BRAND AMBASSADOR MIRA – INTELLIGENCE. ELEGANCE. TECHNOLOGY.  A New Chapter Begins In an era defined by digital transformation, where cybersecurity, artificial intelligence, and enterprise…

A New Chapter Begins In an era defined by digital transformation, where cybersecurity, artificial intelligence, and enterprise…

…

…