From the national greenhouse gas emission reduction target, allocated quotas have become valuable assets of businesses. To increase their competitive position, businesses need to proactively exploit new opportunities from carbon pricing as soon as this market begins to operate in Vietnam.

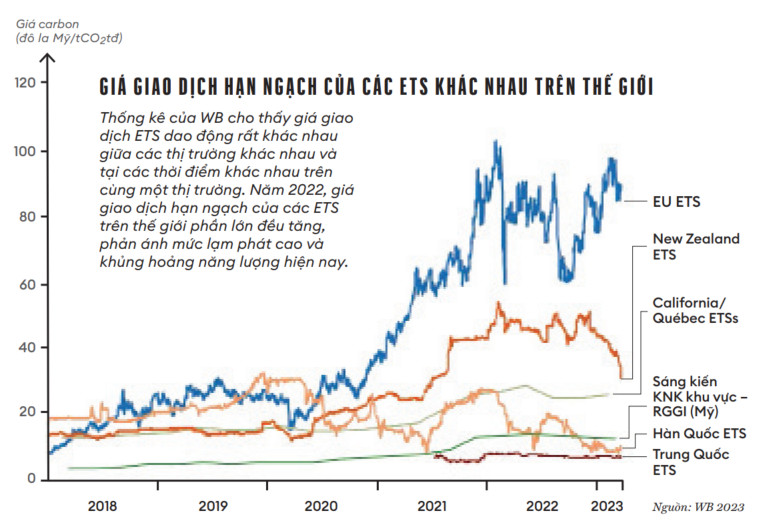

Despite a challenging backdrop for governments facing high inflation, fiscal pressures and the energy crisis, revenues from carbon taxes and emissions trading systems (ETS) have reached record high, about 95 billion USD – according to the annual report “Status and trends of carbon pricing” of the World Bank (WB) published in May 2023.

Human activities are estimated to have warmed the earth by about 1°C compared to pre-industrial temperatures. Global warming due to cumulative anthropogenic greenhouse gas (GHG) emissions since the pre-industrial era will last for centuries to millennia and will continue to cause further long-term changes in the ecosystem. climate system, such as rising sea levels and other negative impacts. Without immediate and deep reductions in GHG emissions in all sectors to limit global warming to 1.5°C, the negative impacts on climate and life on earth are unlikely. reversible. To date, 196 countries have joined the Paris Agreement on climate change with a commitment to reduce GHG emissions and work together towards the 1.5°C target. To achieve this goal, forecast models need to reduce global GHG emissions by about 45% of 2010 levels by 2030 and achieve net zero emissions by 2050.

When emitted into the atmosphere, GHGs are not “local” – emissions from any location or source, when converted to the common unit of tons of CO2 equivalent (CO2td), all have the same global warming impact. However, with different emission sources, the price to reduce emissions is very different, depending on the level of technology as well as economic and social characteristics… Based on this characteristic, the world community has created Create a mechanism to allow transactions for GHG emissions to be priced (called carbon pricing) to educe global GHG emissions at a high cost and efficiency. This is the basis of the current carbon market at all different scales (international, national, regional, industry…). GHG pricing (usually converted per ton of CO2eq, so it is called carbon pricing) is an approach to reduce GHG emissions through the use of market mechanisms, with the creator of GHG emissions having to pay. fee for GHG emissions into the atmosphere according to the “polluter pays” principle.

The carbon market helps achieve emission reduction goals at low cost, and is an effective tool to mobilize private investment and promote investment and innovation in clean technology.

Carbon markets play an important role for countries to raise their emissions reduction ambitions, as they can achieve emissions reductions at lower costs. World Bank research shows that global carbon emission reductions could increase by 50% annually with a carbon market. According to the World Bank’s May 2023 report, the application of carbon pricing tools increased annually in 73 countries and territories covering about 23% of total global GHG emissions.

Applying carbon pricing tools in Vietnam

As a party to the Paris Agreement, Vietnam has committed to the target of reducing GHG emissions by 15.8% unconditionally (with domestic resources) and 43% conditionally (with international support) by 2030. compared to the normal development scenario. Based on this national target, specific GHG emission reduction targets and measures were developed for five main sectors: energy, transport, industrial processes, construction and waste. Correspondingly, large emitting enterprises in these five industries will have to carry out GHG inventory and GHG emission reduction measures. In order to help businesses achieve their GHG emission reduction goals flexibly and at low cost, the Government has stipulated the establishment and exchange of GHG emission quotas and carbon credits on the credit exchange. carbon index and domestic carbon market (Decree 06/2022/ND-CP dated January 7, 2022 on regulations on mitigation of GHG emissions and protection of the ozone layer). According to this decree, the carbon market in Vietnam until 2030 includes two carbon pricing tools:

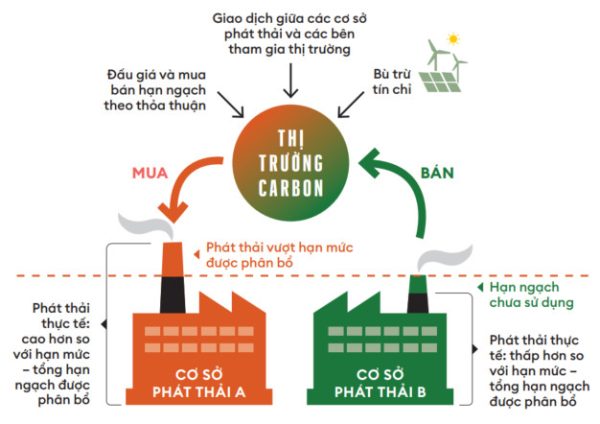

- ETS – also known as cap-and-trade system: The state sets a ceiling on total direct GHG emissions for specific emitters (called emission caps) and establishes a market trading emission rights (emission quotas). Each quota is equivalent to 1 ton of CO2eq and the emission limit is the total number of quotas allocated to 1 facility.

- Credit exchange mechanism: Project activities such as clean energy projects, waste treatment, conservation and afforestation or carbon storage projects… are carried out by businesses or governments, or by Policies that generate emissions reductions can be bought or sold. Emission reductions must be verified by an independent third party and must be officially registered in order to become credits traded on the carbon market (each credit is equivalent to 1 ton CO2eq).

Through allocating GHG emission quotas to specific emission facilities, businesses are obliged to achieve emissions targets within the granted quota but have the right to trade quotas on the ETS. At the same time, carbon credits are offset against the allocated emission limit (but not more than 10% of that limit). Thus, from the national GHG emission reduction target, the allocated quota has become a valuable asset of the enterprise and is valued on ETS, credits generated from renewable energy projects. , low carbon emissions… are traded for use in mandatory or voluntary emissions offsets and converted into emission rights on the ETS at a limited rate.

To carry out emission reduction obligations and trading rights on this ETS, businesses first need to inventory GHGs and evaluate the potential of GHG emission reduction measures and their implementation costs compared to the public average. general technology of its industry or sub-industry. From there, we will build a strategy to reduce GHG emissions with the most effective cost. Businesses can decide to invest themselves to reduce emissions

GHG at the unit if the cost is lower than the quota price and credits on the ETS, or vice versa, buy quotas and credits to offset high emissions, even be fined by the state in the opposite case.

Roadmap for carbon market development in Vietnam

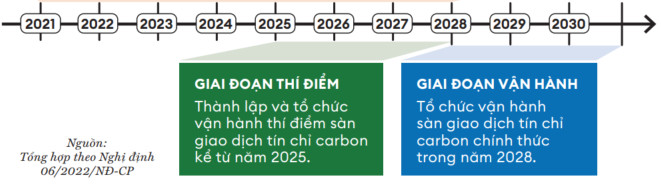

The roadmap includes three main phases with the preparation phase lasting until 2025. Experience from developing and operating the ETS of other countries shows that in the first phase there is only a limited number of businesses participating in the ETS due to the need to complete the ETS. Improve policy mechanisms to manage and operate ETS, so that all parties can become familiar with and adapt to ETS. For Vietnam, it is expected that in the pilot period (2025–2027), only businesses in the fields of cement, steel and thermal power production will be subject to emission limits and allowed to trade on the ETS. After the market develops and officially operates from 2028, the number of businesses and participating parties will be expanded. The Ministry of Natural Resources and Environment presides and coordinates with relevant ministries to organize pilot and official operation of the carbon credit exchange to serve the management, monitoring and supervision of the carbon market; The Ministry of Finance presides over the construction and establishment of a carbon credit exchange and promulgates a financial management mechanism for carbon market operations.

Preparation phase

- Develop regulations for carbon credit management, activities of exchanging GHG emission quotas and carbon credits, and develop regulations for operating the carbon credit exchange.

- Instructions for measuring and monitoring MRV.

- Establishment of a carbon credit exchange.

- Develop a national GHG inventory system.

- Piloting the carbon credit exchange and offsetting mechanism in potential areas and guiding the implementation of the carbon credit exchange and offsetting mechanism domestically and internationally.

- Develop propaganda materials and carry out capacity building activities for carbon market participants.

Subjects participating in the carbon market in Vietnam

Decree 06/2022/ND-CP regulates three groups of participants in the domestic carbon market.

Impact of domestic and foreign greenhouse gas emission reduction policies on Vietnamese businesses

Together with the international community, the Vietnamese Government has committed to implementing the net zero emissions target by 2050. Controlling and reducing GHG emissions at businesses will directly contribute and implement this commitment. First, large enterprises and establishments will be required to report and publish information and plans to reduce GHG emissions. These businesses will then be subject to emission ceilings from 2028 (some businesses within the pilot scope will apply from 2025).

According to world trends, disclosing information on GHG emissions is both mandatory according to national regulations and a requirement of trading partners and consumers. The number of companies disclosing information on GHG emissions increases every year, albeit slowly (from 15% in 2019 to 16.2% in 2021). However, practicing and publishing the results of GHG inventory (carbon footprint calculation) and GHG emission reduction is new to most domestic businesses. If the current trend continues, Vietnam will lag behind surrounding countries in exporting goods, even losing at home when consumers’ awareness of climate change increases.

Vietnam’s textile and garment industry has lost many orders to businesses in Bangladesh, the country rising to the number 2 position in the world from 2022 and continuing to hold this position in 2023. According to statistics, in two months In early 2023, Vietnam’s export turnover to the US will decrease by 15%, while Bangladesh’s will only decrease by 2%. One of the main reasons is that Vietnam has lagged behind Bangladesh in green transformation in the industry. In Bangladesh, the government has applied policies to reduce GHG emissions and increase the use of renewable energy along with necessary financial support in the textile industry to green the supply chain for many years.

On December 13, 2022, the European Union (EU) announced that it will implement the Carbon Border Adjustment Mechanism (CBAM). Accordingly, some goods exported to this market will be subject to a carbon tax based on the intensity of GHG emissions in the production process in the host country. According to estimates, CBAM could account for up to 20% of the cost of iron and steel products exported to the EU when CBAM takes full effect. According to the 2023 survey of the CBAM impact assessment project under the Ministry of Natural Resources and Environment, more than 60% of businesses participating in the survey have heard about CBAM, but the majority do not have much understanding or only understand it. basic information. Businesses with low awareness will have difficulty understanding and preparing for CBAM declaration requirements. With high emission reduction costs, Vietnamese businesses may face many difficulties in improving and converting to clean energy and clean, low-carbon technologies and will thus have to pay higher CBAM taxes. then it will significantly reduce competitive advantage.

During the period 2023–2024, a number of donors will support the Ministry of Natural Resources and Environment to conduct ETS training and simulation courses to help stakeholders equip basic knowledge to be ready to participate in ETS in Viet Nam. There is not much time left for businesses to prepare technical capacity to comply with new requirements and obligations related to reducing GHG emissions as well as exploiting opportunities from the domestic carbon market.

Along with participating in training courses and preparing enough capacity, businesses need to evaluate the impact of policies related to reducing GHG emissions on their development goals. But first, it is necessary to have information about the actual emissions situation through GHG emissions inventory. From there, businesses will proactively come up with decarbonization strategies to have a competitive advantage in production and business as well as in export activities. At the same time, businesses should also proactively exploit new opportunities from carbon pricing as soon as this market begins to operate in Vietnam.

Vina Aspire is a consulting company, providing IT solutions and services, network security, information security & safety in Vietnam. Vina Aspire’s team includes skilled, qualified, experienced and reputable experts and collaborators, along with major domestic and foreign investors and partners to join hands in building.

Businesses and organizations wishing to contact Vina Aspire Company with the following information:

Email: info@vina-aspire.com | Website: www.vina-aspire.com

Tel: +84 944 004 666 | Fax: +84 28 3535 0668

![]()

Vina Aspire – Vững bảo mật, trọn niềm tin